Africa Update: Election Season’s End Gives Surging Kenyan Stocks More Room to Run

News Update: BoI partners Oxfam to empower 4,000 farmers

August 28, 2017

News Update: Food prices remain high despite easing inflation

August 29, 2017In the early days of 2017, Kenyan stocks were trading near their lowest valuations in years. At that time, 27 of the 66 companies listed on the Nairobi Securities Exchange (NSE) had grown their earnings at an average rate of more than 10% during the preceding five years, and 16 of them had grown in excess of 15%. But despite this broad-based growth, the market as a whole traded at a price-to-earnings ratio of just 12.7 and sported an average dividend yield of 6.3%. Nearly half of all listed firms (29 to be exact) traded at a discount to their net asset values.

What was weighing on Kenyan share prices? Two things. First, investors were trying to gauge the impact of a new law governing interest rates. The law, enacted in August of 2016, capped lending rates and put a floor under the rates banks were required to pay on customer deposits.

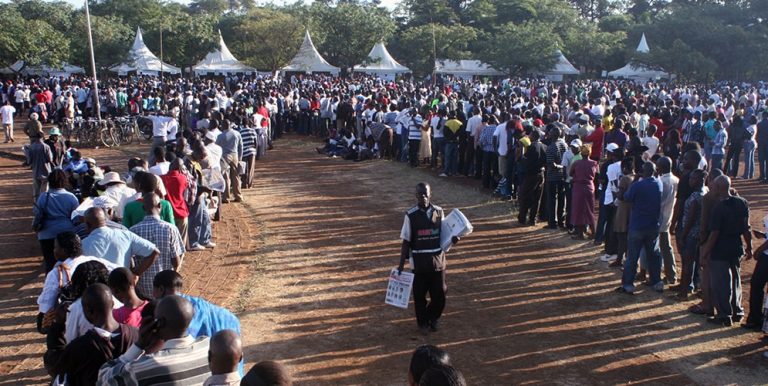

The other factor was the upcoming presidential election. The violence following Kenya’s 2007 poll remains fresh in investors’ minds, and the prospect of another tumultuous election season pulled many of them to the sidelines.

But the mood gradually brightened as the year progressed. Bank profits held up reasonably well despite the new regulatory regime, and government officials hinted that the rules would eventually be relaxed if not removed entirely. And, while the run-up to the election was tense and sporadically violent, it became increasingly clear that the outcome, which saw incumbent Uhuru Kenyatta securing 54.3% of the vote, would not be marred by massive upheaval.

In the early days of 2017, Kenyan stocks were trading near their lowest valuations in years. At that time, 27 of the 66 companies listed on the Nairobi Securities Exchange (NSE) had grown their earnings at an average rate of more than 10% during the preceding five years, and 16 of them had grown in excess of 15%. But despite this broad-based growth, the market as a whole traded at a price-to-earnings ratio of just 12.7 and sported an average dividend yield of 6.3%. Nearly half of all listed firms (29 to be exact) traded at a discount to their net asset values.

What was weighing on Kenyan share prices? Two things. First, investors were trying to gauge the impact of a new law governing interest rates. The law, enacted in August of 2016, capped lending rates and put a floor under the rates banks were required to pay on customer deposits.

The other factor was the upcoming presidential election. The violence following Kenya’s 2007 poll remains fresh in investors’ minds, and the prospect of another tumultuous election season pulled many of them to the sidelines.

But the mood gradually brightened as the year progressed. Bank profits held up reasonably well despite the new regulatory regime, and government officials hinted that the rules would eventually be relaxed if not removed entirely. And, while the run-up to the election was tense and sporadically violent, it became increasingly clear that the outcome, which saw incumbent Uhuru Kenyatta securing 54.3% of the vote, would not be marred by massive upheaval.

Insurance stocks are another area of opportunity. Many Kenyan insurers reduced their exposure to local equities last year, but they began taking steps back into them in recent months. These investment portfolios will likely show big capital appreciation gains in coming months. This, plus an election that passed without widespread property damage, could fuel gains in stocks like Jubilee Holdings and Kenya Re, which trade at price-to-book ratios of 1.5 and 0.6, respectively.

With valuations like these and a less murky political outlook, we’re confident that the NSE’s bull run still has legs.