Moody’s Investors Service has today downgraded the long-term issuer and senior unsecured ratings of the Government of Angola to B2 from B1 and changed the outlook to stable from negative. It also affirmed Angola’s short-term issuer ratings at Not Prime.

The key drivers supporting the downgrade are:

1) Lower economic strength in light of the diminished medium-term growth outlook, constrained by foreign currency shortages, high inflation, lower public sector spending and a weak banking system. Angola still faces the difficult challenge of diversification away from its heavy reliance on oil

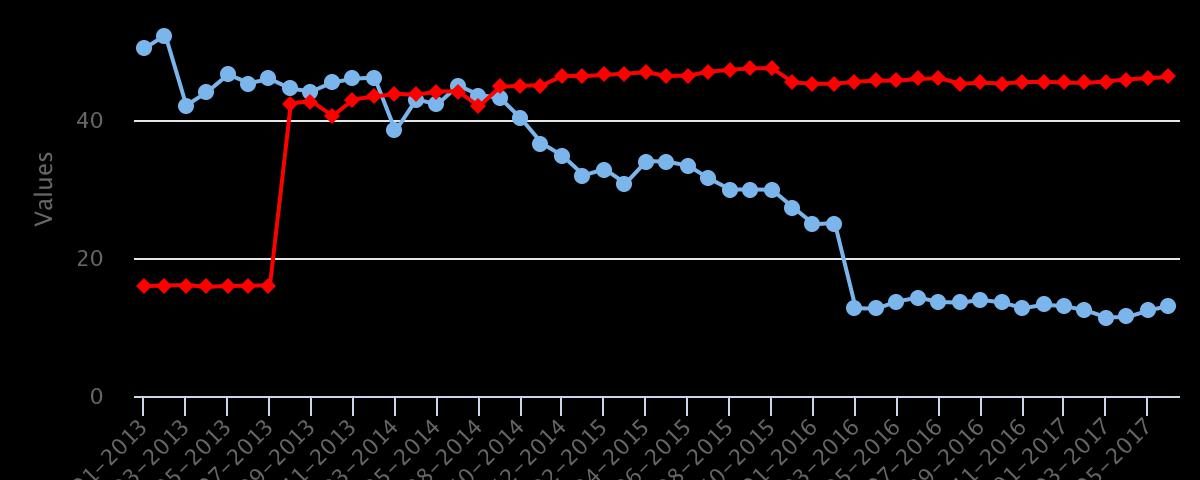

2) Fiscal strength has materially decreased with indebtedness nearly doubling in the past four years, while liquidity risk remains elevated due to significant gross borrowing requirements. The debt-to-GDP ratio remains vulnerable to further currency devaluation and potential crystallization of contingent liabilities from the public sector

3) Persisting external pressures in the form of low dollar liquidity and declining net international reserves, despite higher oil prices and a decreasing current account deficit

The stable outlook reflects the broadly balanced credit pressures at the B2 rating level, with a gradual recovery supported by the oil sector, albeit still well below the average growth rate recorded in the preceding decade. It also reflects the current account’s continued improvement, and the government’s large fiscal adjustment in the past two years aimed at reducing its fiscal imbalance.

Concurrently, Moody’s has lowered Angola’s foreign-currency bond ceiling to B1 from Ba3, the foreign currency deposit ceiling to B3 from B2, and the local currency bond and deposit ceilings to Ba2 from Ba1. The short-term foreign-currency bond ceiling remains unchanged at Not Prime.